Essay

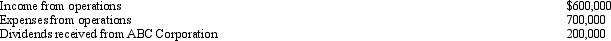

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

Quartz has an NOL,computed as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Income that is included in net income

Q80: A corporation that is not required to

Q82: Azul Corporation,a personal service corporation,had $300,000 of

Q83: As a general rule,a personal service corporation

Q84: During the current year,Yellow Company had operating

Q86: Schedule M-1 is used to reconcile unappropriated

Q87: Starling Corporation,a closely held personal service corporation,has

Q88: Macayo,Inc. ,received $800,000 life insurance proceeds on

Q89: In the current year,Plum Corporation,a computer manufacturer,donated

Q90: C corporations can elect fiscal years that