Multiple Choice

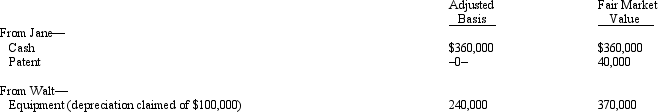

Four individuals form Chickadee Corporation under § 351.Two of these individuals,Jane and Walt,made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000;Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000;Jane has no income.

D) Walt must recognize income of $100,000;Jane has no income.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Joyce, a single taxpayer, transfers property (basis

Q15: Ann,Irene,and Bob incorporate their respective businesses and

Q17: Nancy,Guy,and Rod form Goldfinch Corporation with the

Q18: What are the tax consequences if an

Q31: If a shareholder owns stock received as

Q40: When a taxpayer transfers property subject to

Q44: A taxpayer transfers assets and liabilities to

Q67: Beth forms Lark Corporation with a transfer

Q83: Tara incorporates her sole proprietorship, transferring it

Q103: Amy owns 20% of the stock of