Essay

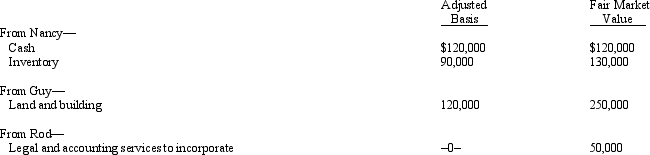

Nancy,Guy,and Rod form Goldfinch Corporation with the following consideration.

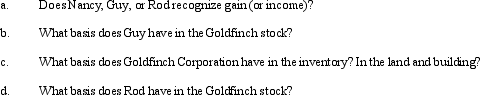

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy,200 to Guy,and 50 to Rod.In addition,Guy gets $50,000 in cash.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy,200 to Guy,and 50 to Rod.In addition,Guy gets $50,000 in cash.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Joyce, a single taxpayer, transfers property (basis

Q15: Ann,Irene,and Bob incorporate their respective businesses and

Q16: Four individuals form Chickadee Corporation under §

Q18: What are the tax consequences if an

Q31: If a shareholder owns stock received as

Q44: A taxpayer transfers assets and liabilities to

Q67: Beth forms Lark Corporation with a transfer

Q83: Tara incorporates her sole proprietorship, transferring it

Q101: Leah transfers equipment (basis of $400,000 and

Q103: Amy owns 20% of the stock of