Essay

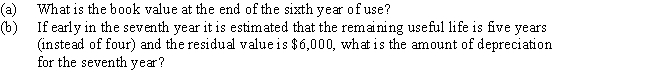

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for six years by the straight-line method.Assume a fiscal year ending December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q36: All property, plant, and equipment assets are

Q40: Revising depreciation estimates affects the amounts of

Q89: Match the intangible assets described with their

Q108: Classify each of the following costs associated

Q123: A gain can be realized when a

Q153: Minerals removed from the earth are classified

Q156: Match each account name to the financial

Q182: Financial statement data for the years ended

Q187: Classify each of the following as:<br>-New landscaping<br>A)Ordinary

Q190: Equipment acquired at a cost of $126,000