Essay

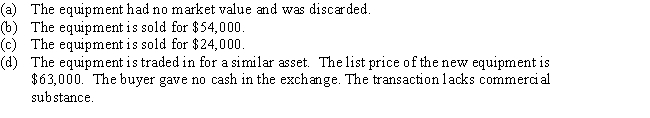

Equipment acquired at a cost of $126,000 has a book value of $42,000.Journalize the disposal of the equipment under the following independent assumptions.  Journal

Journal

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: Match the intangible assets described with their

Q36: All property, plant, and equipment assets are

Q75: If a fixed asset with a book

Q89: Match the intangible assets described with their

Q153: Minerals removed from the earth are classified

Q156: Match each account name to the financial

Q186: Equipment costing $80,000 with a useful life

Q187: Classify each of the following as:<br>-New landscaping<br>A)Ordinary

Q211: Classify each of the following costs associated

Q223: When a company exchanges machinery and receives