Multiple Choice

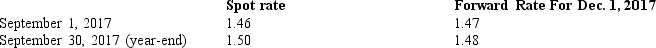

On September 1,2017,Mudd Plating Company entered into two forward exchange contracts to purchase 250,000 euros each in 90 days.The relevant exchange rates are as follows:  The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: From the viewpoint of a U.S. company,

Q20: An indirect exchange rate quotation is one

Q23: A transaction gain or loss on a

Q25: Madison Paving Company purchased equipment for 350,000

Q26: Accounting for a foreign currency transaction involves

Q26: Kettle Company purchased equipment for 375,000 British

Q27: On April 1,2017,Manatee Company entered into two

Q30: On November 1,2017,National Company sold inventory to

Q32: A transaction gain or loss at the

Q33: On November 1,2017,American Company sold inventory to