Multiple Choice

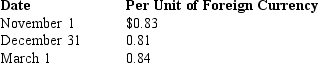

On November 1,2017,National Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of 200,000 foreign currency units (FCU) .On November 1,National also entered into a forward contract to hedge the exposed asset.The forward rate is $0.80 per unit of foreign currency.National has a December 31 fiscal year-end.Spot rates on relevant dates were:  What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

What will be the adjusted balance in the Accounts Receivable account on December 31,and how much gain or loss was recorded as a result of the adjustment?

A) Receivable Balance,$170,000; Gain/Loss Recorded,$4,000 gain

B) Receivable Balance,$162,000; Gain/Loss Recorded,$4,000 loss

C) Receivable Balance,$168,000; Gain/Loss Recorded,$2,000 gain

D) Receivable Balance,$164,000; Gain/Loss Recorded,$2,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q8: From the viewpoint of a U.S. company,

Q20: An indirect exchange rate quotation is one

Q23: A transaction gain or loss on a

Q25: Madison Paving Company purchased equipment for 350,000

Q26: Kettle Company purchased equipment for 375,000 British

Q26: Accounting for a foreign currency transaction involves

Q27: On April 1,2017,Manatee Company entered into two

Q32: On September 1,2017,Mudd Plating Company entered into

Q32: A transaction gain or loss at the

Q33: On November 1,2017,American Company sold inventory to