Multiple Choice

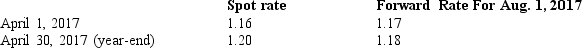

On April 1,2017,Manatee Company entered into two forward exchange contracts to purchase 300,000 euros each in 90 days.The relevant exchange rates are as follows:  The first forward contract was to hedge a purchase of inventory on April 1,payable on December 1.On April 30,what amount of foreign currency transaction loss should Manatee report in income?

The first forward contract was to hedge a purchase of inventory on April 1,payable on December 1.On April 30,what amount of foreign currency transaction loss should Manatee report in income?

A) $0.

B) $3,000.

C) $9,000.

D) $12,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: On November 1,2016,Platte Corporation,a calendar-year U.S.Corporation,invested in

Q5: A transaction loss would result from:<br>A) an

Q7: Greco, Inc. a U.S. corporation, bought machine

Q8: On November 1,2017,Cone Company sold inventory to

Q9: A transaction gain is recorded when there

Q10: On July 15, Pinta, Inc. purchased 88,500,000

Q11: On November 1,2016,Jagged Company sold inventory to

Q14: Montana Corporation a U.S. company, contracted to

Q27: A transaction gain or loss is reported

Q35: The forward exchange rate quoted for the