Essay

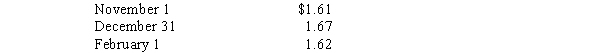

On November 1,2016,Jagged Company sold inventory to a company in England.The sale was for 600,000 British pounds and payment will be received on February 1,2017.On November 1,Jagged entered into a forward contract to sell 600,000 British pounds on February 1 at the forward rate of $1.65.Spot rates for the British pound are as follows:

Jagged has a December 31 fiscal year-end.

Jagged has a December 31 fiscal year-end.

Required:

Compute each of the following:

1.The dollars to be received on February 1,2017,from selling the 600,000 pounds to the exchange dealer.

2.The dollars that would have been received from the account receivable if Jagged had not hedged the sale contract with the forward contract.

3.The discount or premium on the forward contract.

4.The transaction gain or loss on the exposed asset related to the sale in 2016 and 2017.

5.The transaction gain or loss on the forward contract in 2016 and 2017.

6.The amount of the discount or premium on the forward contract amortized in 2016 and 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A transaction loss would result from:<br>A) an

Q8: On November 1,2017,Cone Company sold inventory to

Q9: A transaction gain is recorded when there

Q14: Montana Corporation a U.S. company, contracted to

Q15: Consider the following information:<br>1.On November 1,2017,a U.S.firm

Q16: On September 1,2017,Mudd Plating Company entered into

Q19: During 2017, a U.S. company purchased inventory

Q25: A discount or premium on a forward

Q34: On October 1, 2016, Kill Company shipped

Q35: The forward exchange rate quoted for the