Essay

Consider the following information:

1.On November 1,2017,a U.S.firm contracts to sell equipment (with an asking price of 500,000 pesos)in Mexico.The firm will take delivery and will pay for the equipment on February 1,2018.

2.On November 1,2017,the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1,2018.

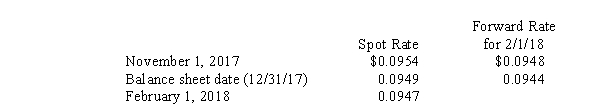

3.Spot rates and the forward rates for February 1,2018,settlement were as follows (dollars per peso):

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1,December 31,and February 1 to account for the forward contract,the firm commitment,and the transaction to sell the equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The discount or premium on a forward

Q9: A transaction gain is recorded when there

Q11: On November 1,2016,Jagged Company sold inventory to

Q16: On September 1,2017,Mudd Plating Company entered into

Q18: Imperial Corp.,a U.S.corporation,entered into a contract on

Q19: During 2017, a U.S. company purchased inventory

Q25: A discount or premium on a forward

Q30: There are a number of business situations

Q33: With respect to disclosure requirements for fair

Q34: On October 1, 2016, Kill Company shipped