Essay

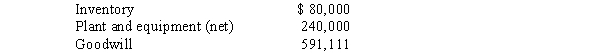

On January 1,2017,Pharma Company purchased a 90% interest in Sandy Company for $2,800,000.At that time,Sandy had $1,840,000 of common stock and $360,000 of retained earnings.The difference between implied and book value was allocated to the following assets of Sandy Company:

The plant and equipment had a 10-year remaining useful life on January 1,2017.

The plant and equipment had a 10-year remaining useful life on January 1,2017.

During 2017,Pharma sold merchandise to Sandy at a 20% markup above cost.At December 31,2017,Sandy still had $180,000 of merchandise in its inventory that it had purchased from Pharma.In 2017,Pharma reported net income from independent operations of $1,600,000,while Sandy reported net income of $600,000.

Required:

A.Prepare the workpaper entry to allocate,amortize,and depreciate the difference between implied and book value for 2017.

B.Calculate controlling interest in consolidated net income for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Noncontrolling interest in consolidated income is never

Q12: Failure to eliminate intercompany sales would result

Q18: Petunia Company acquired an 80% interest in

Q20: The material sale of inventory items by

Q24: Sales from one subsidiary to another are

Q27: The noncontrolling interest's share of the selling

Q28: Poole Company owns a 90% interest in

Q31: P Company owns an 80% interest in

Q32: P Corporation acquired a 60% interest in

Q34: P Company sold merchandise costing $240,000 to