Essay

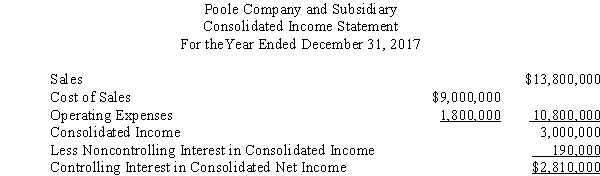

Poole Company owns a 90% interest in Solumbra Company.The consolidated income statement drafted by the controller of Poole Company appeared as follows:

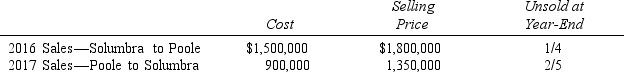

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

Required:

Required:

Prepare a corrected consolidated income statement for Poole Company and Solumbra Company for the year ended December 31,2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Noncontrolling interest in consolidated income is never

Q12: Failure to eliminate intercompany sales would result

Q18: Petunia Company acquired an 80% interest in

Q20: The material sale of inventory items by

Q24: Sales from one subsidiary to another are

Q25: A parent company regularly sells merchandise to

Q31: Past and proposed GAAP agree that unrealized

Q31: P Company owns an 80% interest in

Q32: On January 1,2017,Pharma Company purchased a 90%

Q34: P Company sold merchandise costing $240,000 to