Multiple Choice

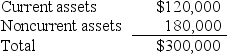

P Company purchased the net assets of S Company for $225,000.On the date of P's purchase,S Company had no investments in marketable securities and $30,000 (book and fair value) of liabilities.The fair values of S Company's assets,when acquired,were:  How should the $45,000 difference between the fair value of the net assets acquired ($270,000) and the consideration paid ($225,000) be accounted for by P Company?

How should the $45,000 difference between the fair value of the net assets acquired ($270,000) and the consideration paid ($225,000) be accounted for by P Company?

A) The noncurrent assets should be recorded at $ 135,000.

B) The $45,000 difference should be credited to retained earnings.

C) The current assets should be recorded at $102,000,and the noncurrent assets should be recorded at $153,000.

D) An ordinary gain of $45,000 should be recorded.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1,2013,Brighton Company acquired the net

Q10: Following its acquisition of the net assets

Q11: North Company issued 24,000 shares of its

Q13: Under the acquisition method, if the fair

Q14: P Corporation issued 10,000 shares of common

Q15: Under SFAS 141R:<br>A) both direct and indirect

Q19: When the acquisition price of an acquired

Q21: Under SFAS 141R, what value of the

Q24: In a business combination, which of the

Q34: Once a reporting unit is determined to