Essay

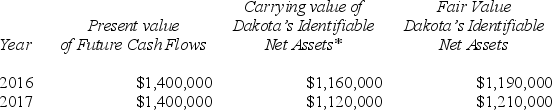

On January 1,2013,Brighton Company acquired the net assets of Dakota Company for $1,580,000 cash.The fair value of Dakota's identifiable net assets was $1,310,000 on his date.Brighton Company decided to measure goodwill impairment using the present value of future cash flows to estimate the fair value of the reporting unit (Dakota).The information for these subsequent years is as follows:

* Identifiable net assets do not include goodwill.

* Identifiable net assets do not include goodwill.

Required:

A: For each year determine the amount of goodwill impairment,if any.

B: Prepare the journal entries needed each year to record the goodwill impairment (if any)on Brighton's books.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: P Company purchased the net assets of

Q10: Following its acquisition of the net assets

Q11: North Company issued 24,000 shares of its

Q13: Under the acquisition method, if the fair

Q14: P Corporation issued 10,000 shares of common

Q15: Under SFAS 141R:<br>A) both direct and indirect

Q19: When the acquisition price of an acquired

Q21: Under SFAS 141R, what value of the

Q24: In a business combination, which of the

Q34: Once a reporting unit is determined to