Essay

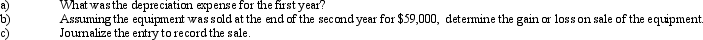

Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

Correct Answer:

Verified

a) $11,250...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Land acquired as a speculation is reported

Q58: When determining whether to record an asset

Q61: A fixed asset with a cost of

Q86: As a company records depreciation expense for

Q87: On June 1, 2014, Aaron Company purchased

Q100: A copy machine acquired with a cost

Q107: The accumulated depletion account is<br>A) an expense

Q144: The exclusive right to use a certain

Q153: Patents are exclusive rights to manufacture, use,

Q206: Costs associated with normal research and development