Essay

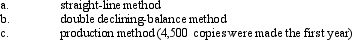

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the

Correct Answer:

Verified

b. Double-declini...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. Double-declini...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: An intangible asset is one that has

Q58: When determining whether to record an asset

Q61: A fixed asset with a cost of

Q86: As a company records depreciation expense for

Q96: Clanton Company engaged in the following

Q102: Equipment was acquired at the beginning of

Q107: The accumulated depletion account is<br>A) an expense

Q144: The exclusive right to use a certain

Q153: Patents are exclusive rights to manufacture, use,

Q206: Costs associated with normal research and development