Essay

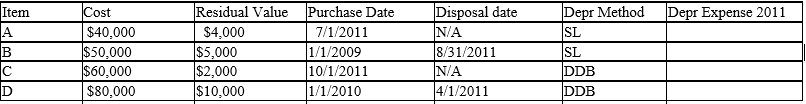

For each of the following fixed assets, determine the depreciation expense and the book value for the dates requested:

Disposal date is N/A if asset is still in use.

Method: SL = Straight Line; DDB = Double Declining Balance

Assume the estimated life was 5 years for each asset.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: On July 1st, Hartford Construction purchases a

Q67: When exchanging equipment, if the trade-in allowance

Q77: A number of major structural repairs completed

Q79: Macon Co. acquired drilling rights for $7,500,000.

Q103: Expenditures for research and development are generally

Q111: Copy equipment was acquired at the beginning

Q116: The amount of the depreciation expense for

Q130: It is necessary for a company to

Q151: On December 31, Strike Company has decided

Q183: The cost of new equipment is called