Essay

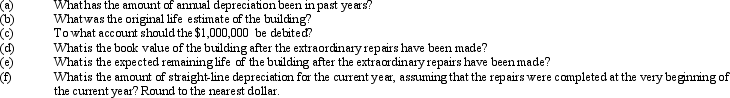

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: When exchanging equipment, if the trade-in allowance

Q73: Both the initial cost of the asset

Q74: For each of the following fixed assets,

Q79: Macon Co. acquired drilling rights for $7,500,000.

Q103: Expenditures for research and development are generally

Q111: Copy equipment was acquired at the beginning

Q116: The amount of the depreciation expense for

Q130: It is necessary for a company to

Q144: The double-declining-balance depreciation method calculates depreciation each

Q169: On April 15, Compton Co. paid $2,800