Essay

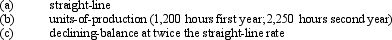

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of 5 years, or 14,000 operating hours, and a residual value of $10,000. Compute the depreciation for the first and second years of use by each of the following methods:

Correct Answer:

Verified

(Round the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Machinery acquired at a cost of $80,000

Q10: On the first day of the fiscal

Q41: A used machine with a purchase price

Q42: Equipment with a cost of $160,000, an

Q47: Xtra Company purchased goodwill from Argus for

Q55: When a company replaces a component of

Q69: When land is purchased to construct a

Q71: A capital lease is accounted for as

Q100: Long-lived assets held for sale are classified

Q112: When a company sells machinery at a