Essay

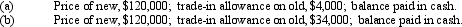

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Equipment purchased at the beginning of the

Q10: On the first day of the fiscal

Q41: A used machine with a purchase price

Q42: Equipment with a cost of $160,000, an

Q47: Xtra Company purchased goodwill from Argus for

Q55: When a company replaces a component of

Q69: When land is purchased to construct a

Q71: A capital lease is accounted for as

Q100: Long-lived assets held for sale are classified

Q112: When a company sells machinery at a