Essay

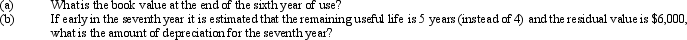

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for 6 years by the straight-line method. Assume a fiscal year ending December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: The book value of a fixed asset

Q31: Computer equipment (office equipment) purchased 6 1/2

Q33: It is necessary for a company to

Q36: A copy machine acquired on March 1,

Q59: A capital expenditure results in a debit

Q79: When selling a piece of equipment for

Q113: Expenditures that increase operating efficiency or capacity

Q123: When cities give land or buildings to

Q135: Capital expenditures are costs that are charged

Q142: For income tax purposes most companies use