Essay

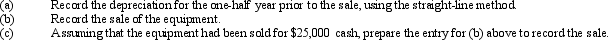

Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Prepare the following journal entries and calculations:<br>

Q34: Equipment costing $80,000 with a useful life

Q36: On December 31, Strike Company has decided

Q36: A copy machine acquired on March 1,

Q59: A capital expenditure results in a debit

Q113: Expenditures that increase operating efficiency or capacity

Q123: When cities give land or buildings to

Q134: When a company discards machinery that is

Q135: Capital expenditures are costs that are charged

Q142: For income tax purposes most companies use