Multiple Choice

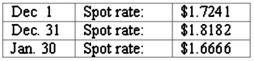

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:

What amount of foreign exchange gain or loss should be recorded on January 30?

A) $1,516 gain.

B) $1,516 loss.

C) $575 loss.

D) $500 loss.

E) $500 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A spot rate may be defined as<br>A)

Q23: What happens when a U.S. company purchases

Q49: A company has a discount on a

Q56: On October 1, 2011, Eagle Company forecasts

Q59: On October 1, 2011, Eagle Company forecasts

Q60: On October 1, 2011, Eagle Company forecasts

Q62: Frankfurter Company, a U.S. company, had a

Q64: Old Colonial Corp. (a U.S. company) made

Q65: On October 1, 2011, Eagle Company forecasts

Q83: What is the major assumption underlying the