Multiple Choice

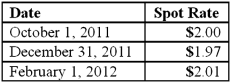

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

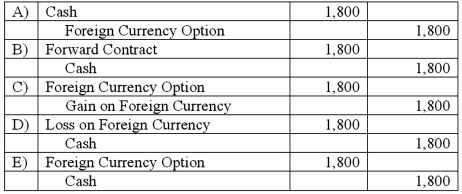

What journal entry should Eagle prepare on October 1, 2011?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A spot rate may be defined as<br>A)

Q23: What happens when a U.S. company purchases

Q23: Which of the following statements is true

Q55: Woolsey Corporation, a U.S. company, expects to

Q56: On October 1, 2011, Eagle Company forecasts

Q60: On October 1, 2011, Eagle Company forecasts

Q61: Norton Co., a U.S. corporation, sold inventory

Q62: Frankfurter Company, a U.S. company, had a

Q64: Old Colonial Corp. (a U.S. company) made

Q83: What is the major assumption underlying the