Multiple Choice

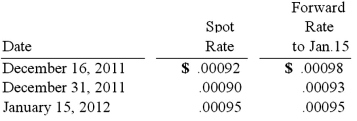

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied:

Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2011 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

A) $700 (gain) .

B) $700 (loss) .

C) $300 (gain) .

D) $300 (loss) .

E) $295 (gain) .

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On May 1, 2011, Mosby Company received

Q8: Atherton, Inc., a U.S. company, expects to

Q9: On March 1, 2011, Mattie Company received

Q11: On April 1, 2010, Shannon Company, a

Q37: Lawrence Company, a U.S.company, ordered parts costing

Q38: U.S. GAAP provides guidance for hedges of

Q53: What happens when a U.S. company purchases

Q90: How does a foreign currency forward contract

Q93: Winston Corp., a U.S. company, had the

Q100: A U.S. company buys merchandise from a