Multiple Choice

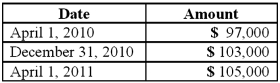

On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows:

How much foreign exchange gain or loss should be included in Shannon's 2010 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: How is the fair value of a

Q8: Atherton, Inc., a U.S. company, expects to

Q9: On March 1, 2011, Mattie Company received

Q10: What is the purpose of a hedge

Q16: On December 1, 2011, Joseph Company, a

Q26: A U.S. company sells merchandise to a

Q31: Meisner Co.ordered parts costing §100,000 for a

Q53: What happens when a U.S. company purchases

Q90: How does a foreign currency forward contract

Q100: A U.S. company buys merchandise from a