Multiple Choice

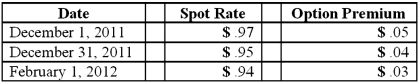

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the U.S. dollars received on February 1, 2012.

A) $138,000.

B) $136,500.

C) $145,500.

D) $141,000

E) $142,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which statement is true regarding a foreign

Q36: Mills Inc. had a receivable from a

Q49: A company has a discount on a

Q49: On April 1, Quality Corporation, a U.S.

Q62: Frankfurter Company, a U.S. company, had a

Q64: Old Colonial Corp. (a U.S. company) made

Q65: On October 1, 2011, Eagle Company forecasts

Q68: On May 1, 2011, Mosby Company received

Q70: Norton Co., a U.S. corporation, sold inventory

Q83: What is the major assumption underlying the