Multiple Choice

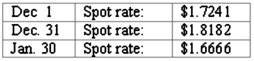

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:

What amount of foreign exchange gain or loss should be recorded on December 31?

A) $300 gain.

B) $300 loss.

C) $0.

D) $941 loss.

E) $941 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which statement is true regarding a foreign

Q10: When a U.S. company purchases parts from

Q36: Mills Inc. had a receivable from a

Q49: A company has a discount on a

Q49: On April 1, Quality Corporation, a U.S.

Q65: On October 1, 2011, Eagle Company forecasts

Q67: On December 1, 2011, Keenan Company, a

Q68: On May 1, 2011, Mosby Company received

Q74: On December 1, 2011, Keenan Company, a

Q75: Woolsey Corporation, a U.S. company, expects to