Multiple Choice

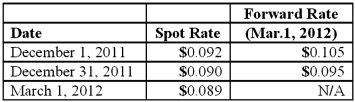

On December 1, 2011, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2012, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply:

Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2011 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $500.00 liability.

D) $490.15 asset.

E) $490.15 liability.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: How is the fair value of a

Q8: Primo Inc., a U.S. company, ordered parts

Q10: What is the purpose of a hedge

Q11: On April 1, 2010, Shannon Company, a

Q13: Where can you find exchange rates between

Q17: On December 1, 2011, Keenan Company, a

Q19: On October 31, 2010, Darling Company negotiated

Q21: On October 1, 2011, Eagle Company forecasts

Q26: A U.S. company sells merchandise to a

Q31: Meisner Co.ordered parts costing §100,000 for a