Multiple Choice

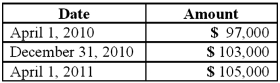

On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows:

How much foreign exchange gain or loss should be included in Shannon's 2011 income statement?

A) $1,000 gain.

B) $1,000 loss.

C) $2,000 gain.

D) $2,000 loss.

E) $8,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Parker Corp., a U.S. company, had the

Q22: Larson Company, a U.S.company, has an India

Q23: Which of the following statements is true

Q23: What happens when a U.S. company purchases

Q39: Williams, Inc., a U.S.company, has a Japanese

Q47: Coyote Corp. (a U.S. company in Texas)

Q51: On December 1, 2011, Keenan Company, a

Q55: Woolsey Corporation, a U.S. company, expects to

Q56: On October 1, 2011, Eagle Company forecasts

Q84: On June 1, CamCo received a signed