Multiple Choice

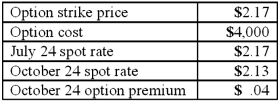

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:

What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

A) $4,000.

B) $5,000.

C) $10,000.

D) $12,000.

E) $14,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A spot rate may be defined as<br>A)

Q22: Larson Company, a U.S.company, has an India

Q23: Which of the following statements is true

Q23: What happens when a U.S. company purchases

Q51: On December 1, 2011, Keenan Company, a

Q52: On April 1, 2010, Shannon Company, a

Q56: On October 1, 2011, Eagle Company forecasts

Q59: On October 1, 2011, Eagle Company forecasts

Q60: On October 1, 2011, Eagle Company forecasts

Q84: On June 1, CamCo received a signed