Multiple Choice

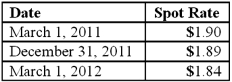

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2011 income as a result of this fair value hedge of a firm commitment?

A) $1,800.00 decrease.

B) $1,760.60 decrease.

C) $2,240.40 decrease.

D) $1,660.40 increase.

E) $2,240.60 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A U.S. company buys merchandise from a

Q16: A U.S. company sells merchandise to a

Q24: Brisco Bricks purchases raw material from its

Q25: Coyote Corp. (a U.S. company in Texas)

Q26: On October 1, 2011, Jarvis Co. sold

Q28: Car Corp. (a U.S.-based company) sold parts

Q30: Car Corp. (a U.S.-based company) sold parts

Q33: Norton Co., a U.S. corporation, sold inventory

Q34: On May 1, 2011, Mosby Company received

Q72: What factors create a foreign exchange gain?