Multiple Choice

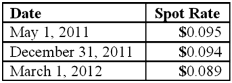

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

A) $0

B) $9,000 net loss on the option.

C) $9,000 net gain on the option.

D) $2,000 net gain on the option.

E) $2,000 net loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A U.S. company buys merchandise from a

Q29: On March 1, 2011, Mattie Company received

Q30: Car Corp. (a U.S.-based company) sold parts

Q33: Norton Co., a U.S. corporation, sold inventory

Q35: Car Corp. (a U.S.-based company) sold parts

Q37: On November 10, 2011, King Co. sold

Q38: On March 1, 2011, Mattie Company received

Q50: For each of the following situations, select

Q72: What factors create a foreign exchange gain?

Q80: Pigskin Co., a U.S. corporation, sold inventory