Essay

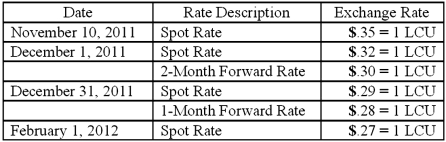

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a cash flow hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2011 net income.

(C.) Compute the effect on 2012 net income.

Correct Answer:

Verified

1 [(.30 - .28) 96,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1 [(.30 - .28) 96,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: A U.S. company buys merchandise from a

Q33: Norton Co., a U.S. corporation, sold inventory

Q34: On May 1, 2011, Mosby Company received

Q35: Car Corp. (a U.S.-based company) sold parts

Q38: On March 1, 2011, Mattie Company received

Q39: All of the following hedges are used

Q41: On October 1, 2011, Eagle Company forecasts

Q50: For each of the following situations, select

Q60: What is meant by the spot rate?

Q80: Pigskin Co., a U.S. corporation, sold inventory