Multiple Choice

These questions are based on the following information and should be viewed as independent situations.

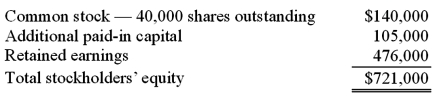

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

A) increase it by $28,700.

B) increase it by $16,800.

C) $0.

D) increase it by $280,000.

E) increase it by $593,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: On January 1, 2009, Nichols Company acquired

Q11: Webb Company owns 90% of Jones Company.

Q33: A parent company owns a controlling interest

Q33: The following information has been taken from

Q43: A parent company owns a controlling interest

Q51: A parent company owns a 70 percent

Q55: Where do dividends paid by a subsidiary

Q70: Cadion Co. owned a controlling interest in

Q105: If newly issued debt is issued from

Q108: In reporting consolidated earnings per share when