Multiple Choice

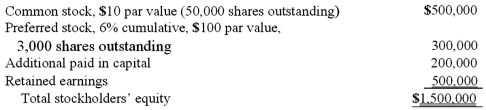

On January 1, 2009, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:

If Smith's net income is $100,000 in the year following the acquisition,

A) the portion allocated to the common stock (residual amount) is $92,800.

B) $10,800 preferred stock dividend will be subtracted from net income attributed to common stock in arriving at non-controlling interest in subsidiary income.

C) the non-controlling interest balance will be $27,200.

D) the preferred stock dividend will be ignored in non-controlling interest in subsidiary net income because Nichols owns the non-controlling interest of preferred stock.

E) the non-controlling interest in subsidiary net income is $30,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: These questions are based on the following

Q11: Webb Company owns 90% of Jones Company.

Q13: Webb Company owns 90% of Jones Company.

Q14: Skipen Corp. had the following stockholders' equity

Q33: A parent company owns a controlling interest

Q33: The following information has been taken from

Q43: A parent company owns a controlling interest

Q55: Where do dividends paid by a subsidiary

Q70: Cadion Co. owned a controlling interest in

Q74: Parent Corporation acquired some of its subsidiary's