Multiple Choice

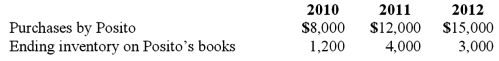

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

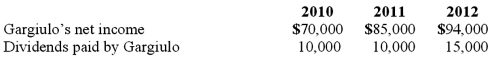

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the equity in earnings of Gargiulo reported on Posito's books for 2012.

A) $84,600.

B) $84,375.

C) $83,925.

D) $84,825.

E) $84,850.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Strickland Company sells inventory to its parent,

Q6: On January 1, 2011, Musial Corp. sold

Q22: McGraw Corp. owned all of the voting

Q31: Justings Co. owned 80% of Evana Corp.

Q57: Chain Co. owned all of the voting

Q59: On January 1, 2010, Smeder Company, an

Q76: Gargiulo Company, a 90% owned subsidiary of

Q79: What is meant by unrealized inventory gains,

Q92: Walsh Company sells inventory to its subsidiary,

Q123: Varton Corp. acquired all of the voting