Multiple Choice

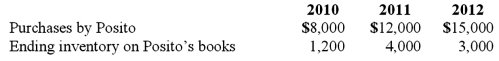

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

A) $3,000.

B) $2,400.

C) $1,000.

D) $800.

E) $900.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Strickland Company sells inventory to its parent,

Q6: On January 1, 2011, Musial Corp. sold

Q22: McGraw Corp. owned all of the voting

Q31: Justings Co. owned 80% of Evana Corp.

Q43: Walsh Company sells inventory to its subsidiary,

Q57: Chain Co. owned all of the voting

Q59: On January 1, 2010, Smeder Company, an

Q74: Gargiulo Company, a 90% owned subsidiary of

Q81: Gargiulo Company, a 90% owned subsidiary of

Q92: Walsh Company sells inventory to its subsidiary,