Essay

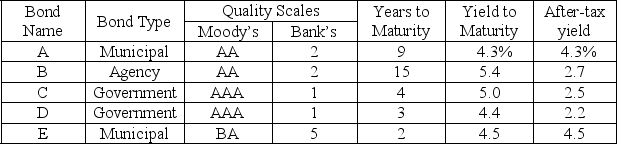

A portfolio manager in charge of a bank portfolio has $10 million to invest. The securities available for purchase, as well as their respective quality ratings, maturities, and yields, are shown in the table below:

The bank places the following policy limitations on the portfolio manager's actions:

1. Government and agency bonds must total at least $4 million.

2. The average quality of the portfolio cannot exceed 1.4 on the bank's quality scale. (Note that a low number on this scale means a high-quality bond.)

3. The average years to maturity of the portfolio must not exceed 5 years.

Assuming that the objective of the portfolio manager is to maximize after-tax earnings and that the tax rate is 50%, formulate a linear program that can be used to determine how much money to invest in each type of bond.

Correct Answer:

Verified

Let A = millions of dollars invested in ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Formulate the following as a linear program.<br>Dane's

Q100: Excel Solver restricts the constraints to either

Q101: Capital Co. is considering which of five

Q102: Car Phones, Inc. (CP), sells two models

Q103: Consider a mathematical program where X<sub>i</sub> represents

Q105: Which Excel tool provides solutions to Linear

Q106: Formulate the following as a linear program.<br>Frank's

Q107: The Village Butcher Shop traditionally makes its

Q108: A feasible solution to an optimization problem

Q109: A constraint in Excel Solver consists of