Multiple Choice

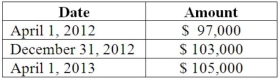

On April 1, 2012, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2013. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2012 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2012 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Where can you find exchange rates between

Q14: Which of the following approaches is used

Q53: What happens when a U.S. company purchases

Q67: Coyote Corp. (a U.S. company in Texas)

Q69: On October 1, 2013, Eagle Company forecasts

Q70: Car Corp. (a U.S.-based company) sold parts

Q75: On October 31, 2012, Darling Company negotiated

Q76: Parker Corp., a U.S. company, had the

Q77: On December 1, 2013, Keenan Company, a

Q90: How does a foreign currency forward contract