Multiple Choice

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on December 31, 2013?

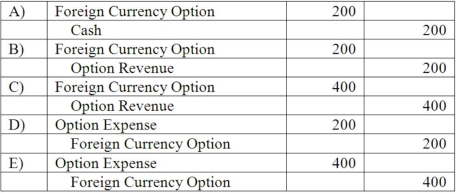

What journal entry should Eagle prepare on December 31, 2013?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Where can you find exchange rates between

Q14: Which of the following approaches is used

Q31: Meisner Co.ordered parts costing §100,000 for a

Q39: Williams, Inc., a U.S.company, has a Japanese

Q53: What happens when a U.S. company purchases

Q66: Car Corp. (a U.S.-based company) sold parts

Q67: Coyote Corp. (a U.S. company in Texas)

Q70: Car Corp. (a U.S.-based company) sold parts

Q72: On April 1, 2012, Shannon Company, a

Q90: How does a foreign currency forward contract