Multiple Choice

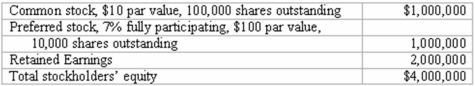

On January 1, 2013, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

A) $(100,000.)

B) $0.

C) $200,000.

D) $812,500.

E) $2,112,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: How does the existence of a noncontrolling

Q46: Webb Company owns 90% of Jones Company.

Q47: A company had common stock with a

Q48: Ryan Company owns 80% of Chase Company.

Q49: A parent acquires 70% of a subsidiary's

Q50: On January 1, 2013, Nichols Company acquired

Q52: Webb Company owns 90% of Jones Company.

Q53: Jet Corp. acquired all of the outstanding

Q54: The following information has been taken from

Q56: Thomas Inc. had the following stockholders' equity