Essay

Jet Corp. acquired all of the outstanding shares of Nittle Inc. on January 1, 2011, for $644,000 in cash. Of this price, $42,000 was attributed to equipment with a ten-year remaining useful life. Goodwill of $56,000 had also been identified. Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2014, Jet reported $280,000 in bonds outstanding with a book value of $263,200. Nittle purchased half of these bonds on the open market for $135,800.

During 2014, Jet began to sell merchandise to Nittle. During that year, inventory costing $112,000 was transferred at a price of $140,000. All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end. Nittle still owed $50,400 for inventory shipped from Jet during December.

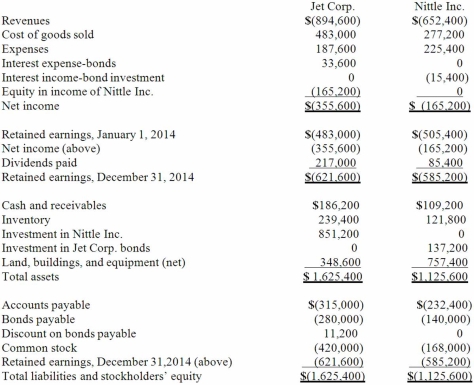

The following financial figures were for the two companies for the year ended December 31, 2014.

Required:

Prepare a consolidation worksheet for the year ended December 31, 2014.

Correct Answer:

Verified

CONSOLIDATION WORKSH...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: How does the existence of a noncontrolling

Q48: Ryan Company owns 80% of Chase Company.

Q49: A parent acquires 70% of a subsidiary's

Q50: On January 1, 2013, Nichols Company acquired

Q51: On January 1, 2013, Harrison Corporation spent

Q52: Webb Company owns 90% of Jones Company.

Q54: The following information has been taken from

Q56: Thomas Inc. had the following stockholders' equity

Q57: Knight Co. owned 80% of the common

Q58: Allen Co. held 80% of the common