Multiple Choice

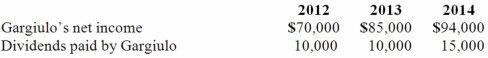

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Compute the non-controlling interest in Gargiulo's net income for 2014.

A) $9,400.

B) $9,375.

C) $9,425.

D) $9,325.

E) $8,485.

Correct Answer:

Verified

Correct Answer:

Verified

Q76: On January 1, 2013, Pride, Inc. acquired

Q77: Pepe, Incorporated acquired 60% of Devin Company

Q78: Pot Co. holds 90% of the common

Q79: What is meant by unrealized inventory gains,

Q82: During 2012, Von Co. sold inventory to

Q83: Gargiulo Company, a 90% owned subsidiary of

Q84: Norek Corp. owned 70% of the voting

Q85: Wilson owned equipment with an estimated life

Q86: On January 1, 2013, Musial Corp. sold

Q100: What is the purpose of the adjustments