Multiple Choice

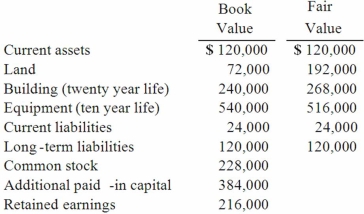

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

The 2012 total amortization of allocations is calculated to be

A) $4,000.

B) $6,400.

C) $(2,400) .

D) $(1,000) .

E) $3,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Which of the following statements is false

Q13: Following are selected accounts for Green Corporation

Q15: Perry Company acquires 100% of the stock

Q16: When consolidating a subsidiary under the equity

Q18: Perry Company acquires 100% of the stock

Q19: Following are selected accounts for Green Corporation

Q21: Velway Corp. acquired Joker Inc. on January

Q22: On January 1, 2012, Cale Corp. paid

Q83: What is the partial equity method? How

Q92: Which of the following is false regarding