Multiple Choice

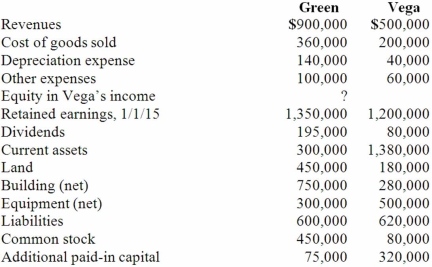

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated revenues.

A) $1,400,000.

B) $800,000.

C) $500,000.

D) $1,590,375.

E) $1,390,375.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Jaynes Inc. acquired all of Aaron Co.'s

Q9: When a company applies the initial method

Q10: Yules Co. acquired Noel Co. in an

Q11: Perry Company acquires 100% of the stock

Q12: Which of the following statements is false

Q15: Perry Company acquires 100% of the stock

Q16: When consolidating a subsidiary under the equity

Q17: On January 1, 2012, Cale Corp. paid

Q18: Perry Company acquires 100% of the stock

Q92: Which of the following is false regarding