Multiple Choice

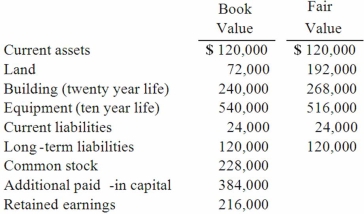

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

At the end of 2012, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co. for

A) $124,400.

B) $126,000.

C) $127,000.

D) $76,400.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dutch Co. has loaned $90,000 to its

Q29: Fesler Inc. acquired all of the outstanding

Q30: Following are selected accounts for Green Corporation

Q31: Under the partial equity method, the parent

Q33: Factors that should be considered in determining

Q35: Racer Corp. acquired all of the common

Q36: Following are selected accounts for Green Corporation

Q38: Under the initial value method, when accounting

Q39: When a company applies the partial equity

Q87: When consolidating a subsidiary under the equity