Multiple Choice

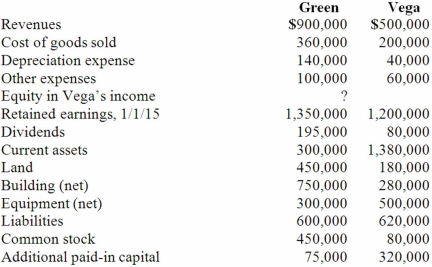

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated additional paid-in capital.

A) $210,000.

B) $75,000.

C) $1,102,500.

D) $942,500.

E) $525,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: For an acquisition when the subsidiary retains

Q4: Dutch Co. has loaned $90,000 to its

Q26: Cashen Co. paid $2,400,000 to acquire all

Q26: How is the fair value allocation of

Q27: Prince Company acquires Duchess, Inc. on January

Q29: Fesler Inc. acquired all of the outstanding

Q31: Under the partial equity method, the parent

Q33: Factors that should be considered in determining

Q34: On January 1, 2012, Cale Corp. paid

Q35: Racer Corp. acquired all of the common