Multiple Choice

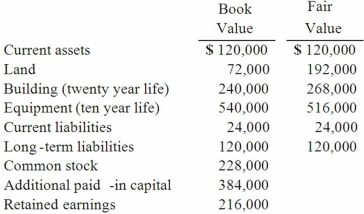

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

If Cale Corp. had net income of $444,000 in 2012, exclusive of the investment, what is the amount of consolidated net income?

A) $569,000.

B) $570,000.

C) $571,000.

D) $566,400.

E) $444,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: When is a goodwill impairment loss recognized?<br>A)

Q69: All of the following are acceptable methods

Q95: Perry Company acquires 100% of the stock

Q96: On January 1, 2012, Cale Corp. paid

Q97: When is a goodwill impairment loss recognized?<br>A)

Q98: Cashen Co. paid $2,400,000 to acquire all

Q99: Goehler, Inc. acquires all of the voting

Q101: Watkins, Inc. acquires all of the outstanding

Q103: Goehler, Inc. acquires all of the voting

Q105: What advantages might push-down accounting offer for