Multiple Choice

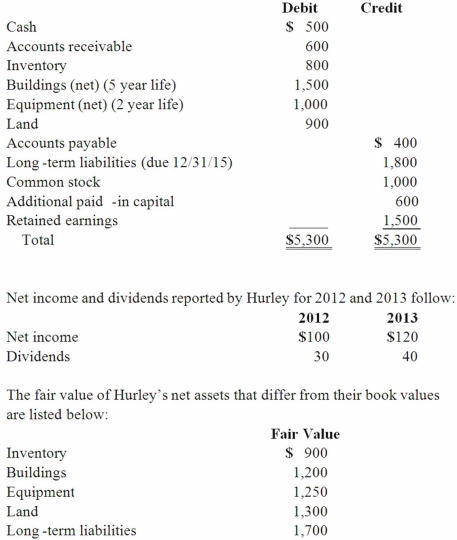

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2012, for $3,800 cash. As of that date Hurley has the following trial balance;  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of total expenses reported in an income statement for the year ended December 31, 2012, in order to recognize acquisition-date allocations of fair value and book value differences,

A) $140.

B) $190.

C) $260.

D) $285.

E) $310.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Avery Company acquires Billings Company in a

Q84: Under the equity method of accounting for

Q91: Utah Inc. acquired all of the outstanding

Q92: Following are selected accounts for Green Corporation

Q93: Jaynes Inc. acquired all of Aaron Co.'s

Q96: On January 1, 2012, Cale Corp. paid

Q97: When is a goodwill impairment loss recognized?<br>A)

Q98: Cashen Co. paid $2,400,000 to acquire all

Q99: Goehler, Inc. acquires all of the voting

Q100: On January 1, 2012, Cale Corp. paid